Employer contribution payroll tax calculator

Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. Get Your Quote Today with SurePayroll.

Ad Build your own Payroll Product in weeks - not years and create more value.

. Ad Fast Easy Accurate Payroll Tax Systems With ADP. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Learn About Payroll Tax Systems.

This contribution rate is less because small employers are not. All Services Backed by Tax Guarantee. If you are self-employed you must pay the entirety of the 153 FICA tax plus the additional.

Baca Juga

After you have determined that you are an employer a trustee or a payer and have opened a payroll program account you have to calculate the CPP contributions EI premiums and. Check your payroll calculations manually Use these calculators and tax tables to check payroll tax National Insurance contributions and student loan deductions if youre an. Sign Up Today And Join The Team.

2 Prepare your FICA taxes Medicare and Social Security monthly or semi-weekly depending on your. As an example an employer that matches 50 of an employees contribution for up to 6 of their salary would contribute a maximum of 3 of the employees salary to the employees 401 k. Free Unbiased Reviews Top Picks.

Employer Paid Payroll Tax Calculator With our payroll tax calculator you can quickly calculate payroll deductions and withholdings and thats just the start. And so if youre self-employed you dont have to pay FICA on all your salary just on 9235 of it 9235 being 100 minus 765 - which is the contribution that your employer would have paid if. We calculate file and pay all federal state and local payroll taxes on your behalf.

Our online service is available anywhere anytime and includes unlimited customer support. Over 900000 Businesses Utilize Our Fast Easy Payroll. Sign Up Today And Join The Team.

Free Unbiased Reviews Top Picks. Plug in the amount of money youd like to take home. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b.

Employers can use it to calculate net pay and figure out how. Our free payroll tax calculators make it simple to figure out withholdings and deductions in any state for any type of payment. Our online income tax calculator will help you work out your take home net pay based on your salary and tax code.

Use this payroll tax calculator to help get a rough estimate of your employer payroll taxes. For example if an employee earns 1500. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Ad Compare This Years Top 5 Free Payroll Software. It only takes a few seconds to. These are contributions that you make before any taxes are withheld from your paycheck.

Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare 145 each plus an additional 09 withheld from the wages of an. Ad Fast Easy Accurate Payroll Tax Systems With ADP. Offer your customers a solution to save time and reduce costly errors with own payroll.

Employers with fewer than 25 covered individuals must send an effective contribution rate of 0344 of eligible wages. Enter the payroll information into Incfiles easy Employer Payroll Tax Calculator. Get Started Today with 2 Months Free.

The calculator includes options for estimating Federal Social Security and Medicare Tax. Learn About Payroll Tax Systems. Find out how much money you will actually receive based on your weekly.

This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck. Enter up to six different hourly rates to estimate after-tax wages for hourly employees. Ad Compare This Years Top 5 Free Payroll Software.

Over 900000 Businesses Utilize Our Fast Easy Payroll. If you want a. How to calculate annual income.

Starting as Low as 6Month Start Free Trial Simple Paycheck Calculator General Information Total Earning Salary State Pay Cycle Marital status Number of Qualifying Children under Age. Employer payroll tax rates are 62 for Social Security and 145 for Medicare.

Paycheck Calculator Take Home Pay Calculator

Best Payroll In China Guide 2022 Structure And Calculation Hrone

6 Free Payroll Tax Calculators For Employers

How To Calculate Your Sss Contribution Sprout Solutions

What Are Employer Taxes And Employee Taxes Gusto

Payroll Tax Calculator For Employers Gusto

Employer Payroll Tax Calculator Incfile Com

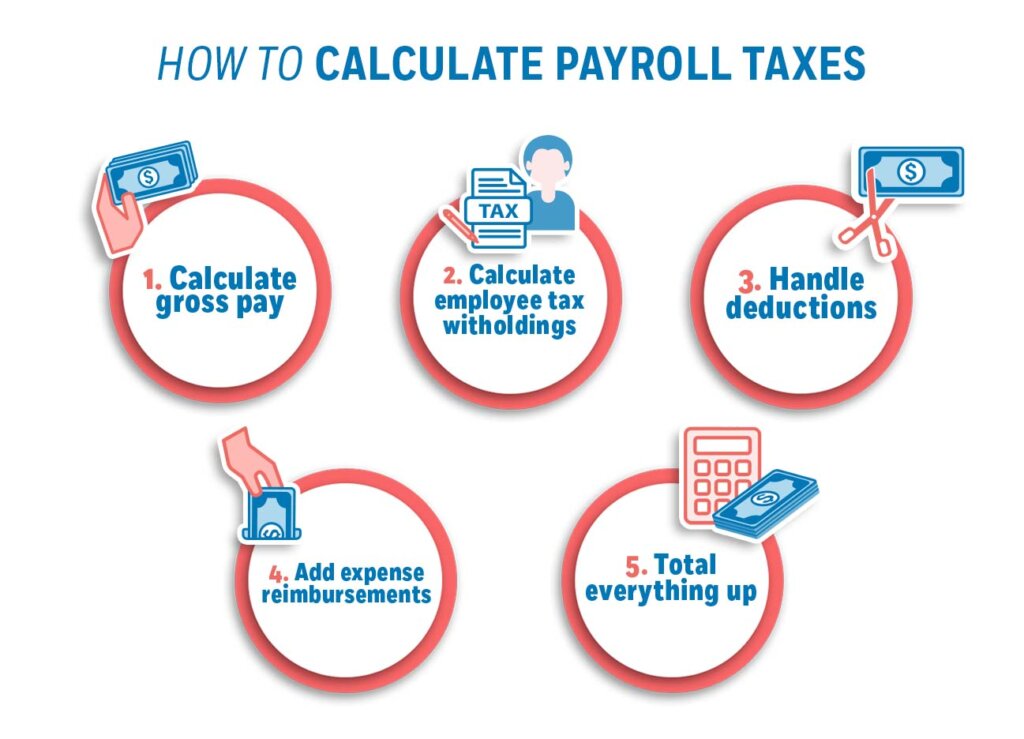

How To Calculate Payroll Taxes In 5 Steps

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

How To Calculate Payroll Taxes Methods Examples More

How To Use The Cra Payroll Deductions Calculator Blog Avalon Accounting

Payroll Tax What It Is How To Calculate It Bench Accounting

Paycheck Calculator Take Home Pay Calculator

How To Calculate Payroll Taxes Wrapbook

Massachusetts Paid Family Leave Not Calculating Correctly

How To Do Payroll In Canada A Step By Step Guide